5. Income would be redistributed to achieve equality

Wage earnings.

Wage earnings, or salary earnings, are the payments a person receives in exchange for working.

Nonwage gains.

In general terms, nonwage gains include all forms of money or benefits a household receives other than wage or salary earnings. These include employer benefits, government payments and benefits, income from owner-operator assets, and returns on the sale of assets they own. In practice, Zion 21.0 would likely not consider everything that households receive to be a reportable nonwage gain. For instance, small gifts and interest on bank accounts would likely not be included. The value that a household receives from its own work, such as washing the dishes or preparing its own taxes, would also likely not be included.

Needs and circumstances.

Needs and circumstances are discussed here.

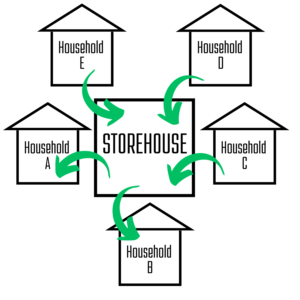

Transferring surplus to the Storehouse.

An example might be useful. Suppose that Zion 21.0 set the equalized income level for the Garcia family and other households with the same needs and circumstances at $72,000 per year, $6,000 per month. Suppose further that the Garcia household had total wage and salary income and non-wage gains of $120,000 per year, $10,000 per month. Each month, the Garcias would retain $6,000 for their own use and transfer $4,000 to the Storehouse as surplus.

Receiving supplemental income from the Storehouse.

An example might be useful. Suppose that Zion 21.0 set the equalized income level for the Fox family and other households with the same needs and circumstances at $72,000 per year, $6,000 per month. Suppose the Fox family had total wage and salary income and non-wage gains of $48,000 per year, $4,000 per month. Each month, the Fox family would retain $4,000 and receive a supplemental payment of $2,000 from the Storehouse.